HR Due Diligence

HR Diagnostics for Investors

Leadership Assessments & Organizational Diagnostics For Successful Investments & Acquisitions

Why conduct an HR Due Diligence?

Before investing in a company or making an acquisition, investors often conduct financial, legal, or strategic audits as part of their due diligence process. Increasingly, they are also performing HR Due Diligence, recognizing the significance of the human factor in the success of their investment or acquisition.

A number of investor studies have shown that the management team and human capital are the primary factors in the success or failure of an investment. Indeed, it is the quality of the management and human organization in place that defines a company’s ability to execute its project and strategy and achieve the expected results.

Investors have access to a very limited number of people in the companies they invest in, and their management contacts, who often have excellent sales and persuasion skills, are in a commercial posture during the investment or sales process. As a result, they tend not to disclose much about the human, managerial and organizational issues of their company.

Our HR Solutions for Investors & Acquirers

We offer comprehensive support to investors to ensure the success of their investments or acquisitions. We conduct audits of the company's human capital, assessments of leaders, and assist management teams in implementing the necessary changes and transformations for their company's success.

A comprehensive organizational audit of the company from the perspective of key people in the organization that identifies areas for improvement to strengthen the company’s performance and anticipate risks. This audit assesses 5 pillars:

- Governance & management team

- Vision & Strategy

- Culture & work quality of life

- Organization & efficiency of operations

- HR Practices

A comprehensive assessment of leaders to identify how to improve their performance and impact. The individual assessment of leaders allows for a better understanding of the leaders, their operating mode, their aspirations, their strengths, and their areas for development. The assessment is based on the analysis of several possible sources of human data:

- Personality tests

- Self-assessment of leadership skills

- 360° feedback on leadership skills

- Career and CV analysis

- Individual interviews

- Taking references

Customized coaching and advisory for leaders and management teams to help them implement the essential changes and transformations needed to boost the company’s performance and results. We advise them in 6 areas:

- Strengthening of leadership

- Development of the management team

- Strategic alignment

- Culture development

- Operational efficiency

- HR strategy

We intervene throughout the investment cycle

We can accompany investors at each stage of their investment to help them achieve superior results and maximize the chances of success for their investments :

Pre-Investment

HR Due Diligence

Audit to gain a better understanding of management and the company, to inform investors’ decision-making by revealing strengths and risks, and to identify post-investment improvement actions.

Post-Investment - Within the first 100 days

Human Capital Optimization Plan

Audit to design a human capital optimization plan and identify the human, managerial and organizational levers for improvement to be activated to enable the company to meet or exceed its objectives.

Throughout the investment period

Annual Human Performance Audit

Annual audit carried out from the perspective of the company’s key people to measure the evolution of human capital evaluation indicators and identify improvement actions.

When the portfolio company is underperforming or facing difficulties

Diagnosis of under-performing or struggling companies

Audit to understand the internal human, managerial and organizational reasons for the underperformance, difficulties or crisis and design a rebound plan by identifying the priority actions to be taken.

The Benefits of Our HR Due Diligence

HR Due Diligence is a valuable tool for investors and executives alike. Its objective is to maximize the success of the company by identifying areas for performance improvement and risk reduction.

Our HR Due Diligence provides invaluable information for understanding the skills, personality and leadership style of senior executives, and for identifying the company’s key human, managerial and organizational challenges. This in-depth knowledge enables investors to make informed decisions and assess leadership’s ability to lead the company to success.

By improving investors’ level of knowledge about the company and its management, we enable investors and management to engage in a healthy relationship based on transparency and information sharing. HR Due Diligence encourages open dialogue on the company’s key issues.

Thanks to our HR Due Diligence expertise, we can quickly identify areas of strength and areas for improvement in a company’s human capital, and propose concrete, targeted recommendations. These measures help investors and managers to put in place a clear action plan to maximize the company’s performance and enable it to succeed.

Our HR Due Diligence implements human capital assessment indicators that provide visibility on the essential human aspects to be monitored. By carrying out a follow-up audit of these indicators every year, we enable investors and managers to measure the evolution of human performance, to better understand the factors influencing the company’s success, and to implement actions for improvement.

Our HR Due Diligence enables us to anticipate human capital risks before they become major problems. By identifying red flags and potential vulnerabilities, we help investors and managers take preventive measures to mitigate risk. By intervening upstream, we promote stability and resilience.

Our Scope of Intervention

We can address various situations by tailoring our approach to the needs, specificities, and expectations of our clients. The use of digital tools makes our process agile and enables us to quickly cover all geographies.

- Private equity or venture capital funds

- Family Office

- Corporates

- SMEs

- Other investors

- Majority or minority

- Acquisitions / Mergers – M&A

- LBO / MBO / MBI

- Growth Capital

- Venture Capital

- Small Cap

- Mid Cap

- Large Cap

- All sectors

- Our audits can be carried out remotely in English or French, anywhere in the world.

Our Audit & Assessment Tools

As part of our HR Due Diligence, we utilize proprietary digital tools developed by WINGMIND, as well as third-party tools

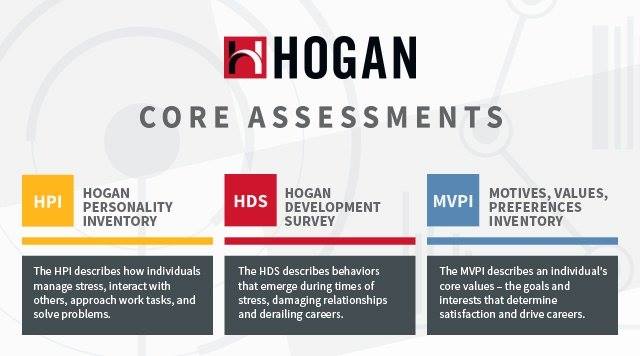

Hogan Assessments / A tool for assessing personality, behavior under pressure and values

- Hogan Assessments are world-renowned personality tests, based on over 40 years of scientific research and recognized in the assessment of leaders. The online tests take between 45 minutes and an hour to complete, with 3 different questionnaires.

- Hogan tests assess 3 dimensions:

- HPI / The “Bright Side”: strengths and limitations in everyday life

- HDS / The “Dark Side “: risks of derailment and behavior under pressure

- MVPI / The “Inside “: values and sources of motivation

WISDOM Index / A tool for self-assessment and 360° feedback for assessing leaders’ emotional, relational, professional and managerial skills

- A proprietary tool from WINGMIND

- An assessment for one person or a group of people with individual and collective results

- Can be used for self-assessment or for a 360 feedback from colleagues

- An assessment of leadership skills based on 4 pillars:

- EMOTIONS / Emotional Intelligence

- RELATIONSHIPS / Interpersonal skills

- PROFESSIONAL EFFICIENCY / Achievement & Performance Skills

- TEAM MANAGEMENT / Managerial skills

- Revealing strengths and weaknesses

- Identification of priority development areas

Scan BUSINESS / A comprehensive organizational audit of the company

- A proprietary tool from WINGMIND

- Assessment of 5 pillars

- Governance & Management Team

- Strategic Alignment

- Culture & Engagement

- Organization & Operations

- HR Practices

- Identifying strengths and weaknesses

- Gathering suggestions for improvement

Contact us

A former private equity investor and entrepreneur, David has been working with executives, entrepreneurs and managers for the past 11 years, helping them to manage and drive change, and to develop their businesses and teams. He specializes in coaching executives and management teams.

- Executive coach & advisor

- HEC Grande Ecole graduate

- Trained in systemic coaching (Organisation and Relationship Systems Coaching) and HOGAN-certified (Leadership Personality Assessments)

- Since 2012: Founder of WINGMIND, a human capital consulting firm specializing in HR audits, assessments and executive coaching.

- 2010-2015: Digital entrepreneur. Founder of Closing Circle, a digital media company dedicated to private equity and mergers & acquisitions, which he sold to the Leaders League media group in July 2015.

- 2005-2010: Private equity investor. European business development manager for a US private equity firm specializing in the acquisition of technology and telecom companies

- Since 2013: Professor of management, entrepreneurship and finance in business schools

WINGBLOG

Our Articles About Relationships Between Investors & Business Leaders

Your contact: David Chouraqui

Your contact: David Chouraqui